Cassie shares how to navigate the new financial terrain.

While 30th Anniversary Edition didn’t technically break the Reserved List, the fact that WotC is printing cards named Black Lotus, Mox Sapphire, and Underground Sea in the year 2022 is one of the biggest pieces of Magic Finance news in years. I have several high-end Reserved List cards in my collection, after all, and it’s probably worth figuring out if I should sell them before WotC finally does cross that forbidden line. More importantly, I have plenty of friends who are saving up their hard-earned cash to pick up pieces of power and original Dual Lands. Should they still be looking to make these purchases, or will 30th Anniversary Edition and its inevitable follow-ups drive Reserved List prices down from their current highs?

Honestly, it’s a good time to re-evaluate our relationship with Reserved List speculation in general. The world has changed quite a bit since the last time I’ve written about this topic. The global economy has gotten more precarious, the modern sports card boom is fizzling out, and the cryptocurrency crash seems to have hit the sorts of people who had thousands of dollars to spend on high end Magic cards pretty hard. Furthermore, there hasn’t been a Reserved List spike of any kind this year, making it the first year without one since 2019.

Put this all together, and we’ve got some really interesting questions to answer. Will Reserved List cards ever spike again, and if so, when? What effect will 30th Anniversary Edition and potential future sets have on these venerable cards? Are some Reserved List cards safe while others are doomed? Are some worth picking up while the prices are “low”?

Hmmm…sounds like a pretty good topic for an article, don’t you think?

Five Years of Reserved List Gains… And Losses

Historically, the best thing to do with Reserved List cards has been to buy them whenever and sell them never. If you snagged a Tropical Island or a Gaea’s Cradle in 2004, 2010, or even 2015, it doesn’t much matter whether you “overpaid” at the time or not. All of those cards are worth a lot more now than they used to be. Market fluctuations or not, the overall trend has remained clear for quite some time.

As the 2010s turned into the 2020s, however, it became obvious that there were pretty distinct peaks and valleys in the Reserved List market. It usually began with a small handful of Reserved List cards spiking, generally because of a buyout or some large-scale Legacy or Vintage event. The other high-end Reserved List cards would follow, keeping pace. Then folks would start buying out the cheaper cards. Before long, every Reserved List card that could even theoretically see play somewhere would be exploding in price.

This cycle of FOMO was self-perpetuating. As Reserved List cards spiked, players would talk themselves into buying in because, well, it’s not like they’re ever going to be printing more of these cards, are they? There was this sense of “if I don’t buy them now, then they might quadruple in price again and be out of range forever.” Prices would rise for about a month, then flatten out as the eyes of the community moved on to the next big thing. Then Reserved List prices would slowly erode — though not back to their previous lows — until the next hype cycle came around again.

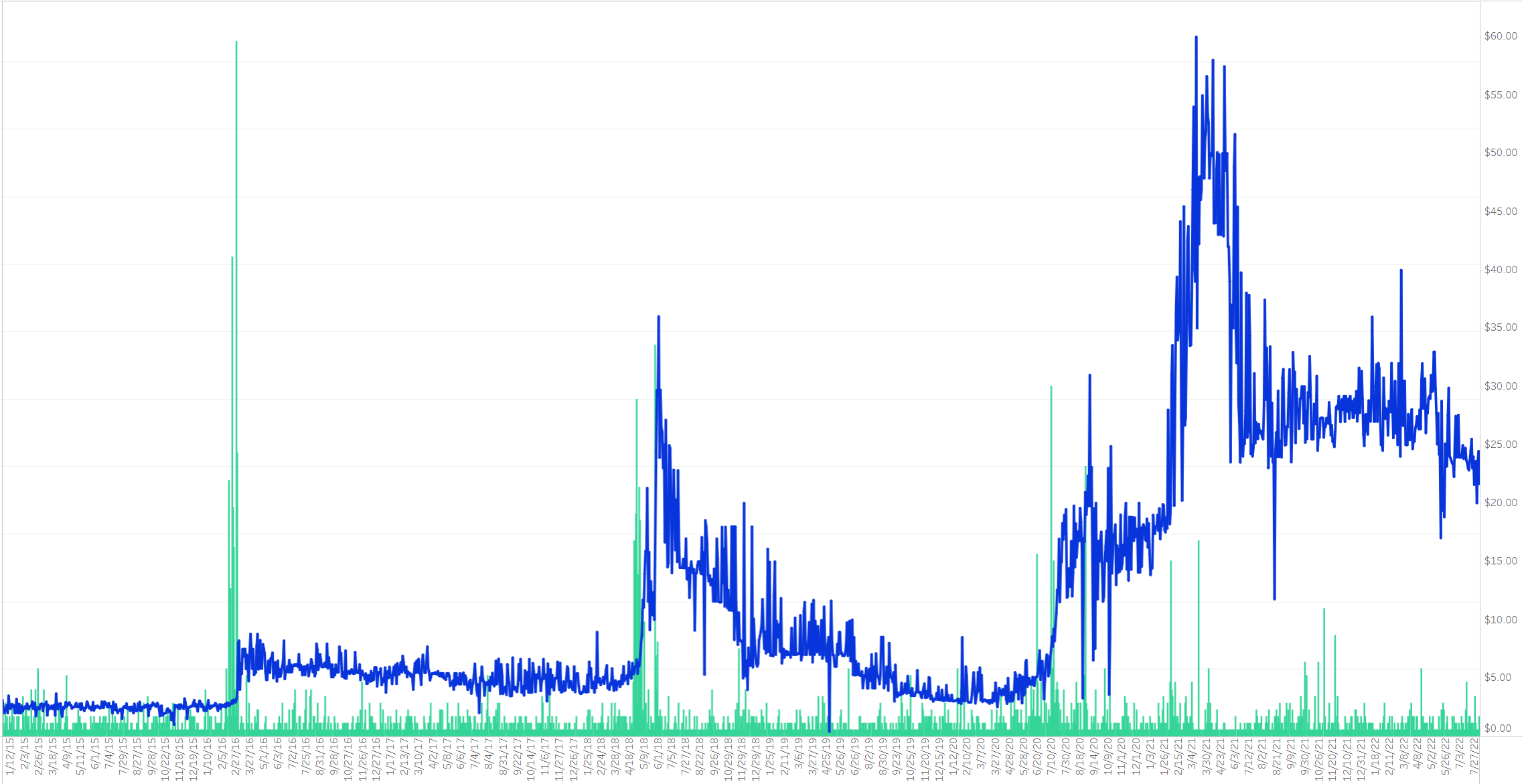

This pattern repeats itself over and over again in the Reserved List price charts, though the dips are far more pronounced in the second and third tier cards. For example, here’s Peacekeeper:

As you can see, there were Peacekeeper buyouts in February of 2016, May of 2018, July and August of 2020, and June of 2021. The price surged and then dropped each time, as folks bought in, triggered FOMO, spiked the price, and then the card was subsequently forgotten about. Even still, a card that was just $2.50 in 2015 sells for about $25 now, a ten-fold increase in price.

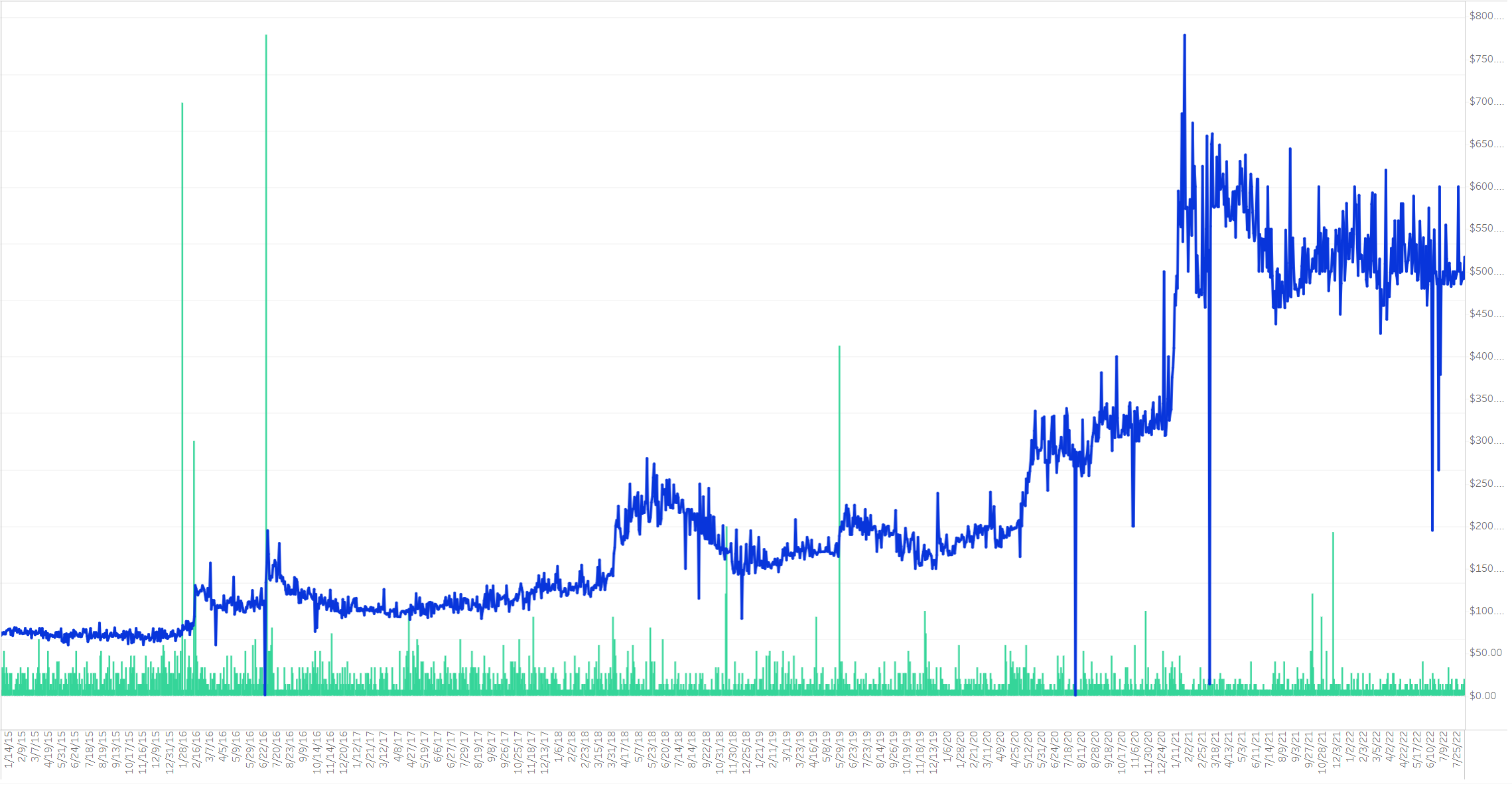

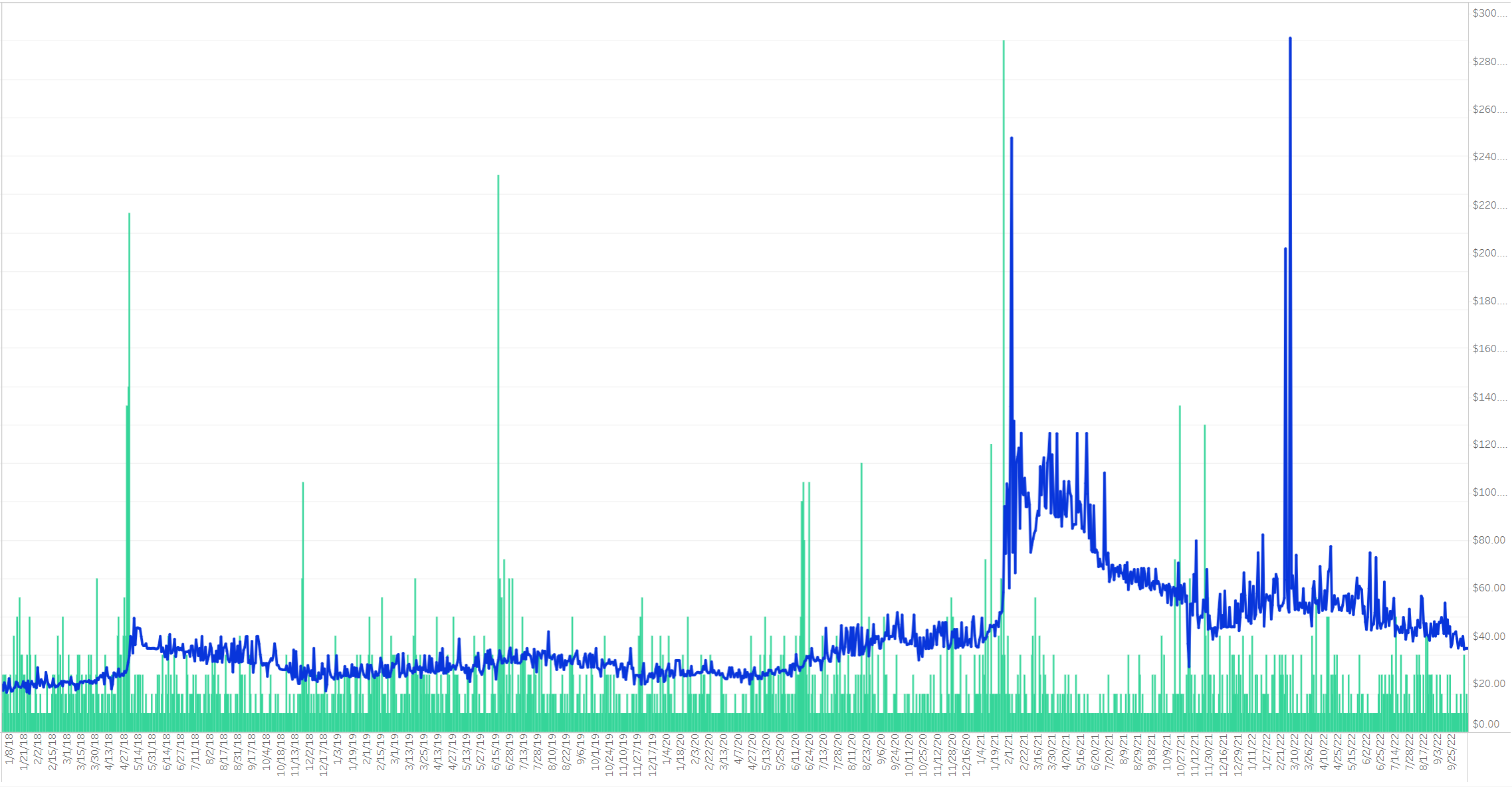

The same pattern exists in high-end Reserved List cards, though with far less pronounced drops. Check out Lion’s Eye Diamond:

You can still see the same spikes at the same points on the chart: 2016, 2018, 2020, and 2021. This time, however, the card simply didn’t lose as much value on the downswing. While Peacekeeper went from $36 to $3 between 2018 and 2020, and it went from $60 down to $25 between 2021 and now, Lion’s Eye Diamond only dropped from $700 to $500 over the past two years, and lost just $130 in value during the 2018 to 2020 plunge. Those are still significant losses, but far less pronounced.

These charts also do a great job of showing why Reserved List speculation remains so tantalizing. There have been spikes every year or two for all of Magic’s current era, and the last one happened more than a year ago now. Prices have come down quite a bit since then, which means that there’s loads of money to be made if these cards even just hit their previous heights, much less if they can spike beyond that. The question, then, is this: are we still in this basin-and-range era of having Reserved List spikes every year or two, or has something fundamentally changed about either the game or the world that will prevent the next spike from happening? Because if not, then we should all be picking up Reserved List staples as quickly as we can right now…right?

The Case for Buying Reserved List Cards in 2022

The best case for buying Reserved List cards right now? To me, it’s the old adage that past performance is the most reliable indicator of future results. We’ve seen these cards spike over and over again for years, so why wouldn’t they spike again in the future? It’s always safer to bet on an established pattern continuing than on this being the exception that breaks the rule. And if there’s even one more spike like the past four, you’ll make quite a bit of money if you buy in now and sell into the hype.

Plus, from an optimistic perspective, 30th Anniversary Edition might be the best thing that could have happened to these old cards. First, it shows that WotC is still committed to following the letter of the Reserved List, regardless of the community blowback about “thousand-dollar proxies.” The absurd price point for 30th Anniversary Edition also helps cement the idea that the current secondary market value of Reserved List cards is something that WotC seems intent on preserving, at least for the time being. After all, if 30th Anniversary Edition had either been tournament legal or a whole lot cheaper, you could make a pretty compelling case that there was very little reason to invest in actual Reserved List cards anymore, since they would be effectively undercut by these reprints. As it is, 30th Anniversary Edition seems pretty clearly designed to not hurt the price of existing Reserved List cards at all, even at the expense of becoming the most-hated Magic product of all time.

Most importantly, though? High-end Reserved List cards are collectors’ items on par with the highest end collectables in every sphere. Black Lotus is right there alongside Action Comics #1 or a Mickey Mantle rookie card, and these are the types of collectables that can withstand almost everything the market has to throw at them. They are so scarce and in such high demand that WotC could mail everyone in the world a free Black Lotus with a 2022 date stamp on it and it wouldn’t affect the price of the original one iota. I can get a reprint of Action Comics #1 shipped to me for less than $10 total. A copy of the original with a 9.0 grade still sold for 3.2 million last year. If our society still exists in twenty years, at the 50th Anniversary of Magic, high grade copies of original Black Lotus might be pushing the three-million-dollar mark.

The Case Against Buying Reserved List Cards in 2022

A lot has changed over the past few years, and most of those things could be a problem for the future price of Reserved List cards.

First, the Vintage and Legacy communities — which weren’t terribly large to begin with — have shrunk considerably. The ballooning price of Reserved List staples certainly didn’t help reverse this trend, but the biggest culprits were the pandemic and WotC taking an axe to their Organized Play infrastructure. Competitive Magic is a far smaller part of the overall game now, and large tournaments are few and far between. Because of that, most of the events that do pop up are Standard, Modern, or Pioneer — you know, the formats that at least feign financial accessibility. And why spend thousands of dollars on a Legacy deck if you’re never going to get to play it?

Second, the crypto-driven card-collecting boom of the early pandemic era seems to be over. There was a period in 2020 and 2021 where sports and Pokémon card collecting exploded in popularity, to the point where card grading services had to double their prices and still ended up with six-month backlogs. This boom was mostly influencer-driven, but it had gas from rich collectors who didn’t have anything better to spend money on during a time when restaurants were closed and vacations were out of the question, as well as free money pouring into their wallets via unsustainable cryptocurrency and NFT gains. While this bubble didn’t reach Magic in the way I thought it would, this process still helped drive the Reserved List spikes of 2020 and 2021.

Pokémon and sports card prices have come back down to Earth again now, though, and the crypto space has collapsed entirely. Furthermore, rising prices from inflation and corporate price gouging over the past year has cut into most people’s discretionary incomes considerably. Put simply, there is just a lot less spare cash floating around in the high-end Magic space than there was a few years ago.

Third, WotC has spent the last several years looking at Magic’s secondary market and saying, “hmmm…. how much of this can we take for ourselves?” This started with the Masters sets, where WotC realized they could charge more for a booster pack as long as it included cards that had a high value on the secondary market. It then evolved into Collector Boosters, Secret Lairs, and all the other ways they used the theoretical price of cool new versions of existing cards to charge a premium. 30th Anniversary Edition is really just a further evolution of this mindset, driven by the fact that Collectors’ Edition prices had spiked to incredibly high highs despite not actually being tournament legal. Regardless, the overall goal is simple: get as much of the money that would have gone into the secondary market for Magic to end up in the hands of WotC instead.

Is this actually a problem for Reserved List cards, which are (at least for now) the only things that WotC can’t reprint? Perhaps. For one, Reserved List spikes can only happen when the community isn’t suffering from extreme wallet fatigue, and there was really no chance for that to happen in 2022. There was always another set, another release, another way to spend money. At what point, exactly, was the community supposed to focus on the Reserved List? Heck, this was the first year where the bottom really fell out of a bunch of sealed box prices, in large part because of this extreme product-overload-driven wallet fatigue. If WotC keeps releasing sets at this pace — and it sure looks like they will — then there just isn’t going to be a lot of opportunity for money to suddenly end up buoying the price of cards that were last printed in 1995.

Lastly, we have the contents of 30th Anniversary Edition itself. As we discussed last week, does anyone really think that WotC is going to stop here? If this product really does sell out at $999, why wouldn’t they go back to that well with products containing Gaea’s Cradle and The Tabernacle at Pendrell Vale? And after that, why not run back Duals and Power again? And again? And again? It’s true that these cards aren’t tournament legal, but honestly, who is playing Tropical Island in a sanctioned tournament in 2022? All WotC really needs is to get these products normalized to the point of functional legality in Commander, and that’s the ballgame. That might not happen this year, but in five years? Ten? It seems inevitable to me, despite the community’s current stance on these thousand-dollar proxies.

Establishing A New Reserved List Taxonomy

If you’ve made it this far, then you can probably see that there isn’t a clear answer to the question, “should you buy Reserved List cards in 2022?”. It’s definitely riskier than it was, and there are some pretty clear signs that we’re in a fundamentally different marketplace than we were a year or two ago, but we might be missing out on some fantastic opportunities if we ignore the Reserved List entirely.

To that end, I want to try and establish a Reserved List taxonomy that isn’t just “high end” and “low end.” That way, we can discuss each category of Reserved List card separately. After all, there’s a pretty large difference between a near mint Beta Black Lotus and a heavily played Badlands, right? Both are high-end cards, but they have an entirely different potential customer base. It would be silly to assume that these two cards would continue to rise and fall in tandem forever, despite the fact that they’re both high end Reserved List cards.

Putting together everything we’ve learned today, here’s my best shot at a five-tier taxonomy for the Reserved List:

Tier One: Someone Might Write a News Article About This Card When You Sell It

This tier only has a few hundred cards on it. Not a few hundred named cards — a few hundred actual pieces of cardboard. I’m talking mainly about Alpha and Beta power graded PSA 8.0 and up, as well as PSA 9.0 and up copies of Unlimited Power, Alpha and Beta dual lands, etc.

You probably don’t own any cards on this tier. You probably never will. These cards are immune to overall market forces, since their only real market is people who have more money than you will ever make in your lifetime. They are extremely safe to buy (if you can, which you cannot), and will likely be worth far more in a decade than they are now, barring some sort of system-wide economic revolution or collapse.

Tier Two: These Cards Are Immune from Reprints

This tier includes all cards from Alpha and Beta as well as cards in gradable condition from Arabian Nights, Legends, Antiquities, and Unlimited. As with tier one, these cards don’t derive much of their value from playability, but are instead part of a robust high-end collectors’ market. For example, a Beta Llanowar Elves sells for $130 in Lightly Played condition, despite the fact that you can get a 4th Edition copy for less than twenty-five cents.

The thing that all of these cards have in common? WotC cannot hurt their value with reprints. No future printing of Llanowar Elves can hurt the price of Beta Llanowar Elves. Ditto for every single card in Alpha and Beta, as well as very clean copies of other cards from the pre-The Dark era. These are the cards that generally get brought up when people argue that abolishing The Reserved List wouldn’t actually affect the prices of old Magic cards, and it’s true… for cards in this category and above.

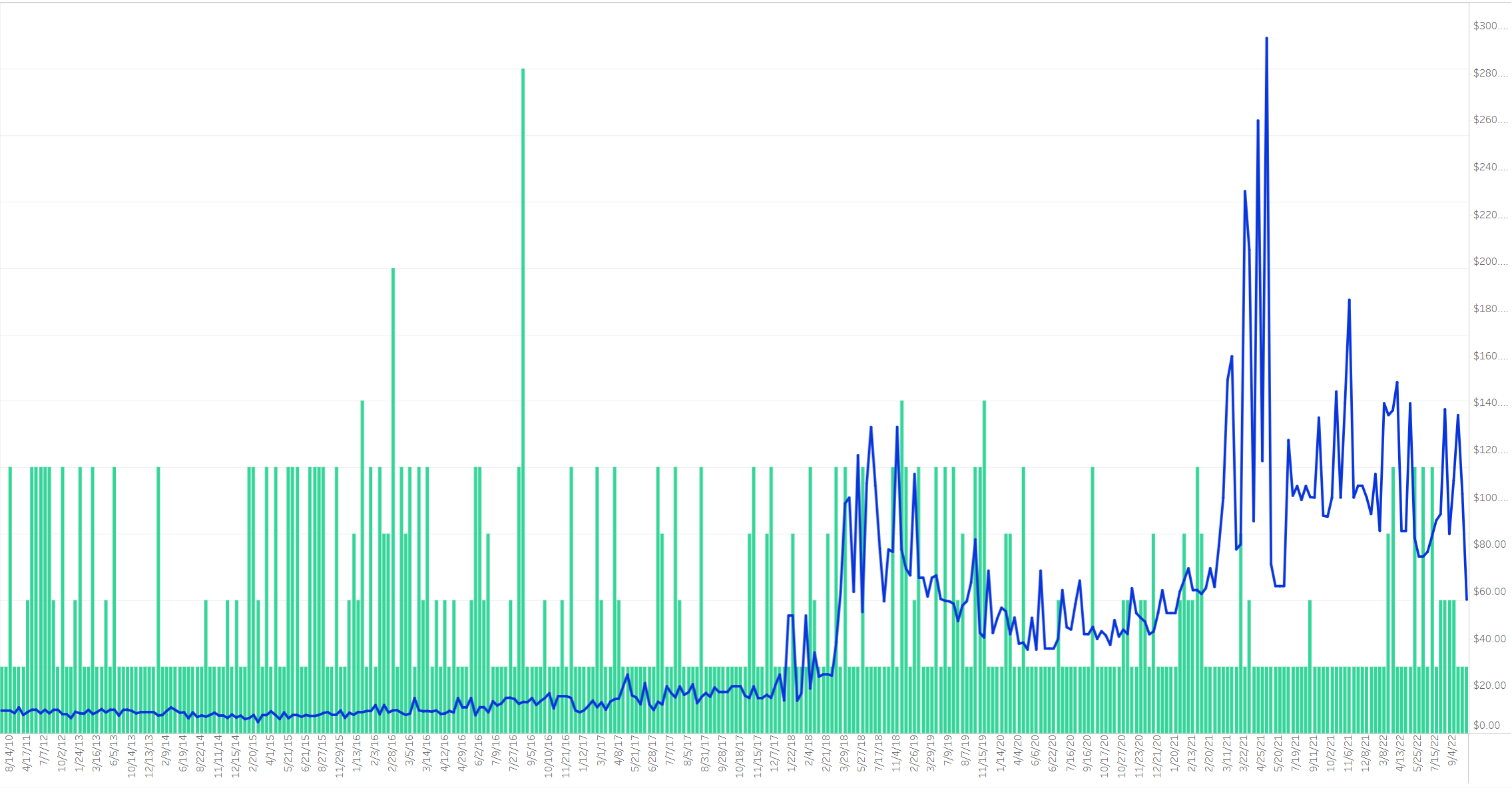

Cards in this category aren’t immune from overall market trends, though. For example, take a look at this price chart for Beta Llanowar Elves from 2010 through now. The data is messy, because minor changes in condition affect the value of cards like this a lot, but you can still see a peak in 2019 followed by a trough in 2020, another spike in 2021, and then a drop again through today:

Despite these fluctuations, I still think that cards from this tier are among the safest, surest buys in the game. Alpha and Beta cards have an aura to them that WotC can never replicate, no matter what they reprint. Only a few hundred of these cards exist, and they represent the very beginning of a game — heck, an entire industry — that is still growing, thirty years later. No 30th Anniversary Edition card could ever match the feeling of actually owning a piece of this history. As long as the game remains popular in the future, and I expect it will, then these cards will have an opportunity to spike again. If you can get good deals on these cards, and you have the money to spend, I think it’s a very solid long-term hold.

Tier Three: These Are the High-End Tournament Staples

This tier includes the Revised Dual Lands, Mox Diamond, Lion’s Eye Diamond, Gaea’s Cradle, The Tabernacle at Pendrell Vale, heavily played Unlimited Power, and all the other cards that make Legacy and Vintage so dang expensive. When players say “abolish the Reserved List!”, these are the cards they are hoping to own on the cheap.

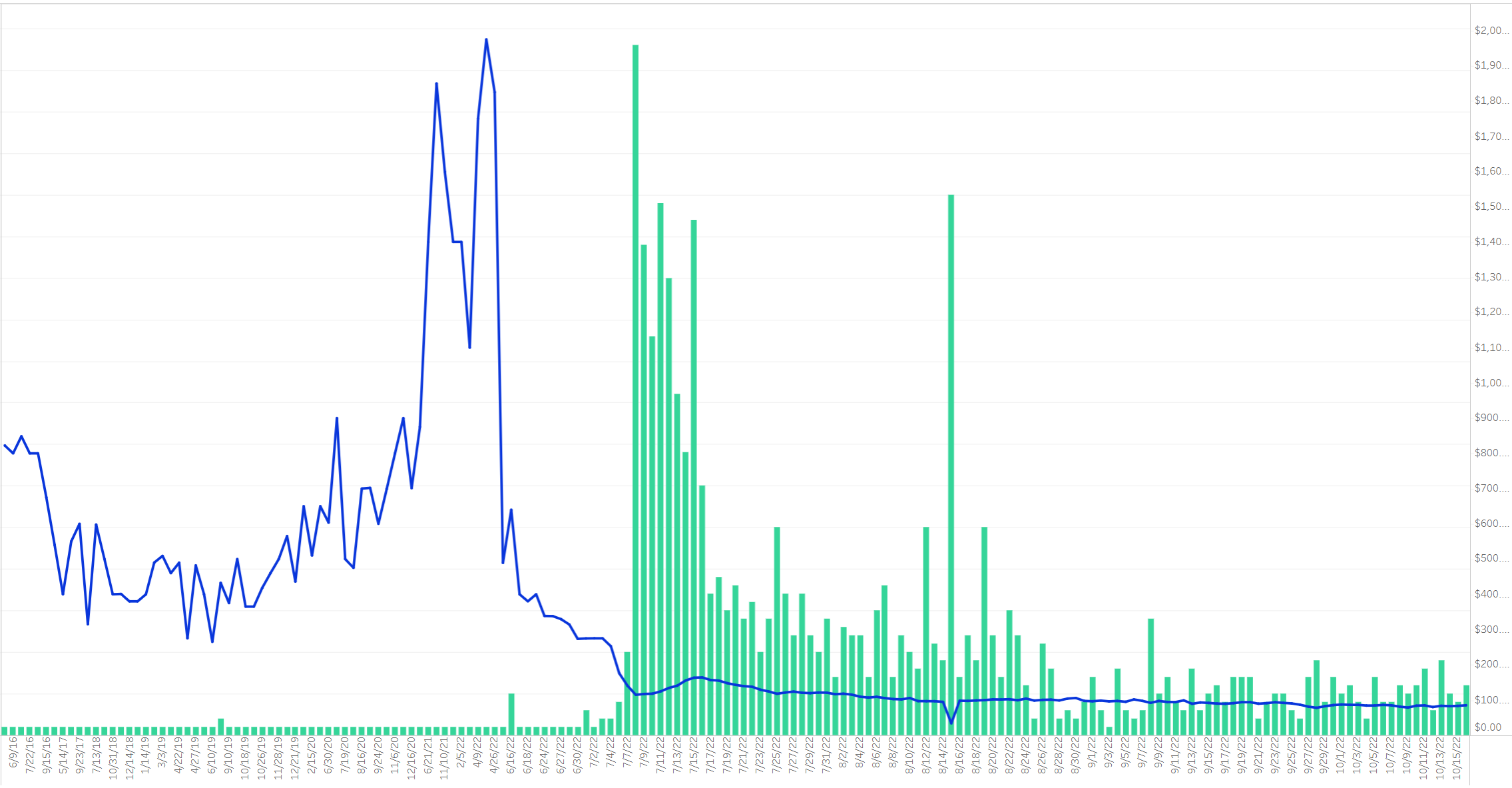

These are also the cards that would be absolutely crushed by WotC actually breaking the Reserved List, because they derive their current value primarily due to scarcity. Want to see this process in action? Take a look at the price chart of Imperial Seal, a card that was a pseudo-Reserved List staple until being reprinted in Double Masters 2022:

Yeah. Imperial Seal fluctuated between $400 and $800, for years, then spiked into the $1,500 range, then tanked when the reprint was announced. Despite being in a Masters set with expensive packs and limited availability, it’s pretty easy to find a copy for right around $80 now. The Portal Three Kingdoms version is still theoretically worth $1,7000, the cheapest price currently listed on the TCGplayer marketplace, but not a single copy has sold since before the reprint was announced, so it’s unclear what the actual fair market value is for this card. Good luck finding a buyer at any fair price if you have one.

It’s hard to know what would happen to actual Reserved List staples like this if WotC broke their promise, though. Even if WotC rips off that particular band-aid, which they’ve shown no signs of doing, they will likely be hidden in packs at a similar price point to 30th Anniversary Edition — not Double Masters 2022. In that case, then the worst-case-scenario for these cards involves WotC breaking the Reserved List, and then slowly releasing products with lower and lower price points until these cards have tanked entirely. That might happen eventually, but I don’t think it will happen soon.

The real problem, as I see it, is that these cards simply don’t have the upside they once did. I don’t think the competitive Vintage or Legacy scenes will be coming back anytime soon, and more Commander players are realizing they can either proxy these cards or go without these thousand-dollar staples. The more cards WotC releases, after all, the less need there is to own any specific card, least of all one that was last printed three decades ago.

I’m definitely not selling the Duals I already own, and cards on this tier have proven incredibly resilient over the past few years, but if I’ve got money to invest in, I’d rather get something off the Immune from Reprints tier, which is both safer and has higher long-term upside right now.

Tier Four: These Cards Are Good in Commander

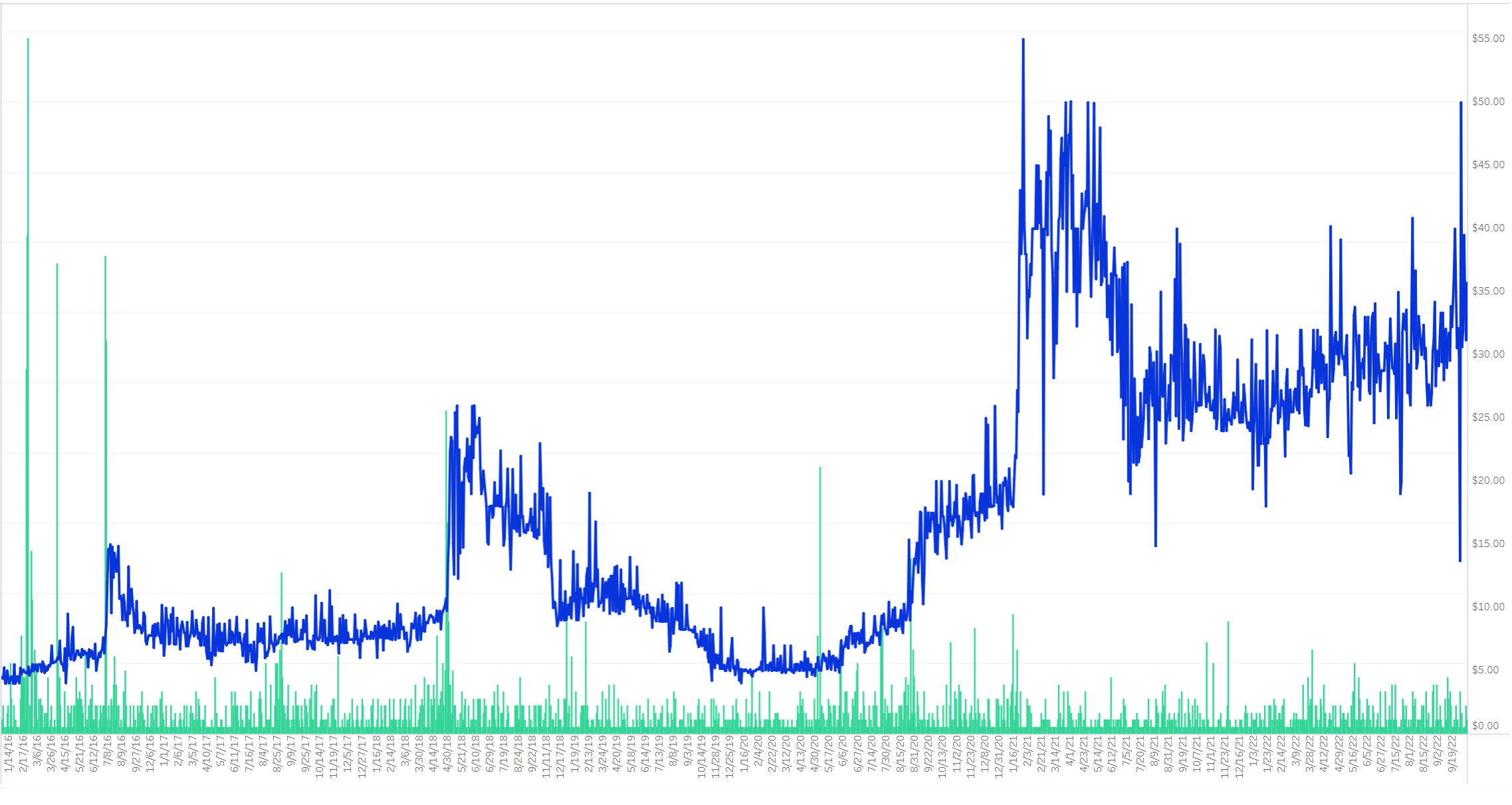

This tier includes cards that have a chance at spiking whenever WotC releases a new Commander that combos well with them. Palinchron, Yavimaya Hollow, Shallow Grave, Willow Satyr, Copy Artifact, Gilded Drake, etc. These cards have had some pretty wild fluctuations over the years, as evidenced by the price charts. For example, here’s Palinchron:

And here’s Shallow Grave:

In many ways, these cards are safer buys than those on the Tournament Staples tier. For one thing, the format that they shine in is still on the rise, instead of on the wane. For another, they seem less likely to be the target of future 30th Anniversary Style official proxies than the $200+ Dual Lands and such.

These cards are also easier purchases to justify. They tend to be cheaper, for one thing, and they are usually important combo pieces in Commander. They will also generate fewer eyerolls at the table, since one of the risks of running high-end Reserved List cards in your Commander deck is generating the ire of everyone else at the table and putting a huge target on your back. You’re probably not going to do that with Shallow Grave, but you absolutely will with Gaea’s Cradle.

These cards are also better speculation targets than high-end tournament staples right now, for a few reasons. First, you don’t need to wait for an overall Reserved List spike that may or may not come for them to surge in value. A Reserved List spike will increase their price tags, certainly, but so will hype for a new Commander that combines best with their strengths. And since WotC is printing dozens if not hundreds of exciting new Commanders every year now, you’re going to have quite a few bites at the apple every single time.

Most importantly? These cards actually drop in price enough to make speculation interesting. Tropical Island hasn’t been cheap in years, but Palinchron jumped from $25 to $130, then dropped back to $40, then surged to $75, then dropped back down to $35 — all within the past two years. If you like buying low and selling high, and you’re willing to keep a close eye on the marketplace, then cards on this tier still present an incredibly lucrative opportunity — at least as long as WotC continues to follow the letter of the Reserved List.

Tier Five: Hey, At Least It’s on The Reserved List!

Did you know the Reserved List contains hundreds of silly old cards that aren’t good in anything? It’s true! Wood Elemental, Sorrow’s Path, Farmstead, Yare…the list goes on.

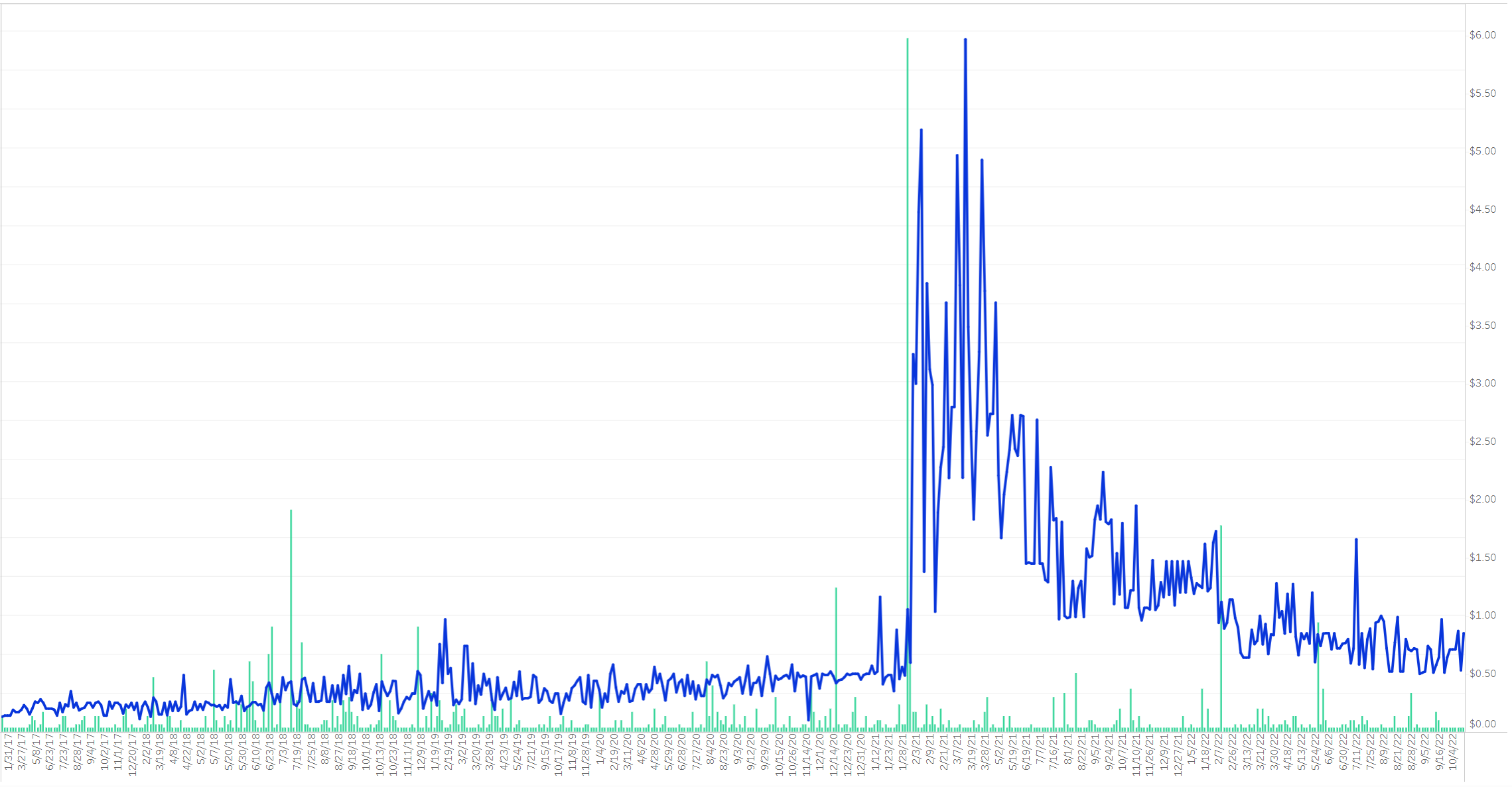

Believe it or not, most of these cards have spiked at least once. For example, here’s the price chart for Yare:

$6 isn’t much for a Reserved List card, admittedly, but it’s a pretty big gain for anyone who bought in at $0.25 and sold at or near peak. And don’t get it wrong: the Reserved List is the only reason this card isn’t a complete bulk rare. It can be tempting to think about snagging these cards again now that they’re down around $0.50 again, but this is the exact type of thing that will only see a price increase if there’s another massive Reserved List price spike, complete with a tremendous amount of community FOMO. That might happen, but I wouldn’t count on it.

Ultimately, I suggest only buying cards that are good, and even then, only when the price is cheap. Hey, that’s a pretty straightforward conclusion, isn’t it? Gosh, maybe this financial analysis stuff is simpler than I thought! Let’s all go get some pizza and call it a day.