Don’t count your chickens, count your dollars instead!

There was once a time when I was pretty good at Magic. Not make “the Pro Tour good”, but definitely “3-0 Draft pods on the regular” good. You can’t always win, though, especially when you play plenty of Limited, because your deck just isn’t going to come together every time. That’s just how it goes.

One week, back in the summer of 2013, I beefed an FNM Draft badly that I didn’t win a single game. On my way out of the store, I bought a single Russian Language Booster Pack of Dragon’s Maze as a consolation prize. It was the current set at the time, and I needed a serotonin boost to take the bad taste of the botched FNM out of my mouth.

Voice of Resurgence

Dragon’s Maze

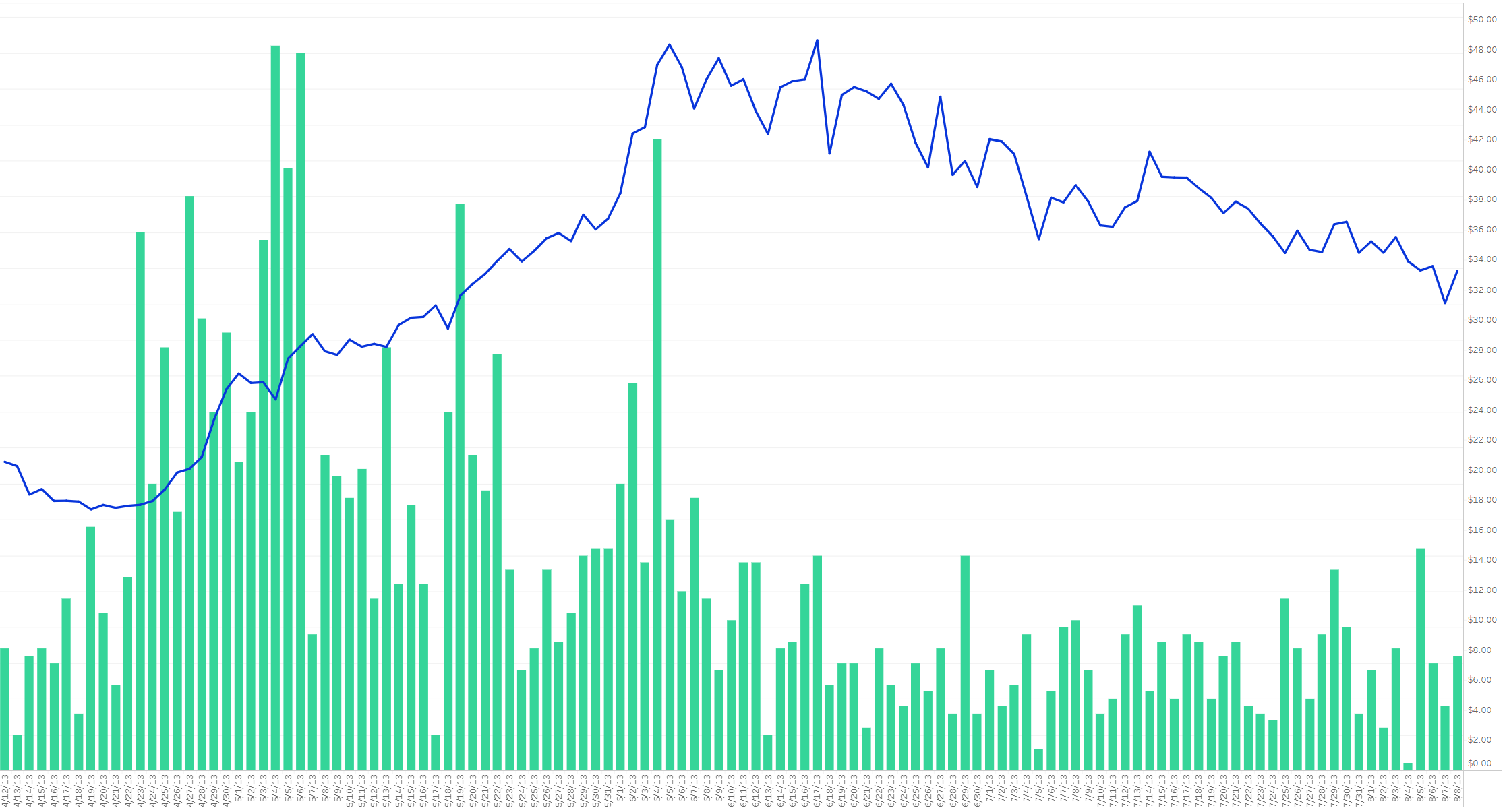

When I got home, I let my partner crack the pack. The Rare? Voice of Resurgence. It was the most expensive card in the set at the time, and nothing else came particularly close. Its price chart as of that day would have looked a little something like this:

Hey, not bad! The card had come down from the nearly $50 it hit in mid-June, but it was still a decent $30-$35 Mythic Rare. The fact that it was in Russian also gave it a premium, and I felt like I could likely sell it for $40-$45 or trade it for close to $50 in the right deal. I also figured it might shoot back up again in the fall, metagame-depending, making it a pretty attractive hold. So instead of selling or trading the card, I slipped it into my personal collection and forgot about it. It’s still there today.

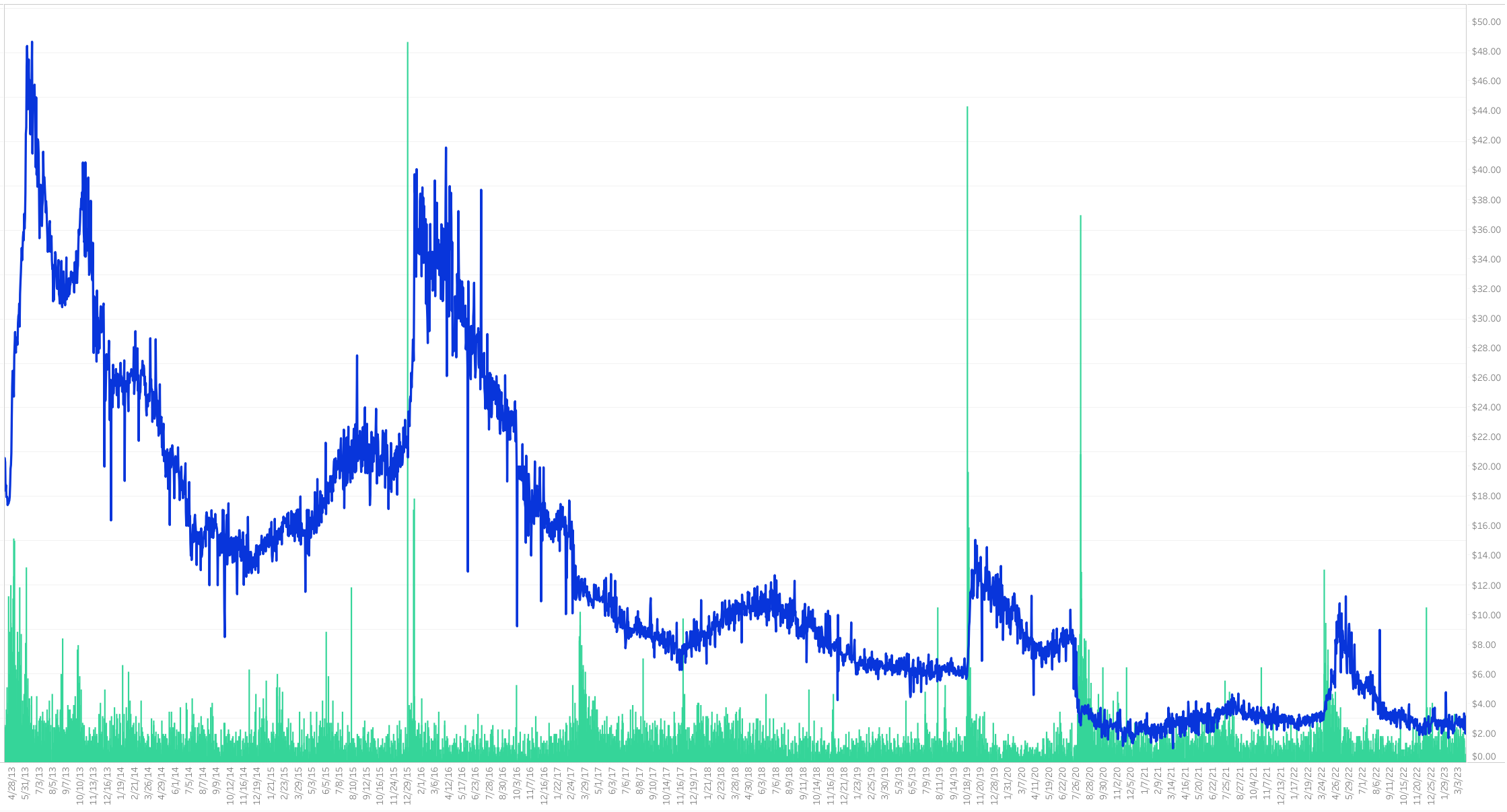

Oops, this is what the price chart for Voice of Resurgence looks like over the past decade:

As you can see, there were other opportunities to sell or trade this card at a pretty decent rate. It did, in fact, briefly rebound in the fall of 2013, hitting $40 that October. It peaked again in February of 2016, approaching $40 once more. Then came Modern Masters 2017, and the price tanked for good. Throw in a third printing due to Double Masters, and you can see why all subsequent spikes were so much lower, even when the metagame briefly favored this card again. These days, I’d probably have to price my Russian Voice of Resurgence at $3 or so.

Everyone has a rough bead story (or two) about cards they’ve sold too soon. That Underground Sea you parted with in Middle School, perhaps, or even just the Atraxa, Grand Unifier you sold for store credit at the Phyrexia: All Will Be One prerelease, just before we knew just how good that card would end up being. Those stories stick with us, sometimes quite viscerally, reminding us that we held that tiny piece of cardboard in our hands and called it ours, before parting with it for a song. It hurts even more when you realize that you have to buy another copy of that card now, and you’re priced into paying two, three, even ten, or twenty times as much as you sold it for back in the day. I could rattle off a few dozen of these stories, and sometimes they even come back to haunt me as thoughts of inadequacy race through my head during sleepless nights, tossing and turning in bed.

Gaea’s Cradle

Urza’s Saga

Market Price: $958.58

But here’s the thing: for every card I sold too soon, there are twenty or thirty cards I sold too late or didn’t sell. These little stories aren’t quite as memorable or haunting as, say, the Gaea’s Cradle I sold for less than a hundred bucks right before it spiked, but they add up —fast. If I’d been more aggressive in selling cards when they were hot, my collection would be in better financial shape now — even if that meant having sold even more cards well before they began spiking.

My goal today is to talk about selling cards. Why you should do it more than you think, how to make that happen, which cards to avoid selling and more. After all, buying cards to speculate on is well and good, but that’s only half the story. If you want to make money, even to bulk up your personal collection, you have to sell.

Don’t Count Your Chickens

One of my biggest pet peeves is people saying they “made $X” on a given speculation, buy, or cracked booster box before selling a single card. It’s an impulse I’ve had to curb in myself, too. For instance, I could have pointed to that Voice of Resurgence and claimed that I “made $20” even after you accounted for my FNM entry fee and the cost of that single booster. In fact, I probably said exactly that at the time.

But did I make $20? No, I did not. I spent money on the pack, opened a decent card, kept the card, and still have it today. I spent $3.50 or so on the booster pack, and I’ve made nothing. That’s a total gain of negative three dollars and fifty cents.

This is one of the things that WotC is counting on to get us all to buy more products. If we all feel like we made money on the boxes we open, we’ll be more likely to justify buying future boxes because hey, the last one was a pretty good investment! It doesn’t actually register to us that most of those cards were shoved in boxes and binders, forgotten about for years. The box was good! We “made money!”

Now listen, I have no problem with buying cards to keep or buying boxes to crack for fun. I love having a massive Magic collection, and I’m sure most of you do, too. But it’s worth reminding ourselves, again and again, that we haven’t made any profit until we’ve actually sat down and sold the cards that we don’t actually want to hold in our personal collections. If you’re engaging with this game on a financial level, you need to have active selling. Otherwise, you’re not “speculating” on anything. You’re just hoarding cardboard.

Selling into Hype

There’s a classic Simpsons bit where Homer has money to burn because he invested his savings in pumpkin futures. They’ve been surging in price all October, and he figures that they’ll probably peak sometime in mid-January. Cut to a picture of rotting pumpkins on the day after Halloween, and you get the picture. I’m sure I’ve referenced this gag in an article before, because it’s just so perfect. When you see the line go up, and up, and up, it can be so tempting to think that the boom will never stop. After all, sometimes holding through the initial hype period is correct. For instance, take a look at the chart for Myr Matrix from the start of the year through the end of February:

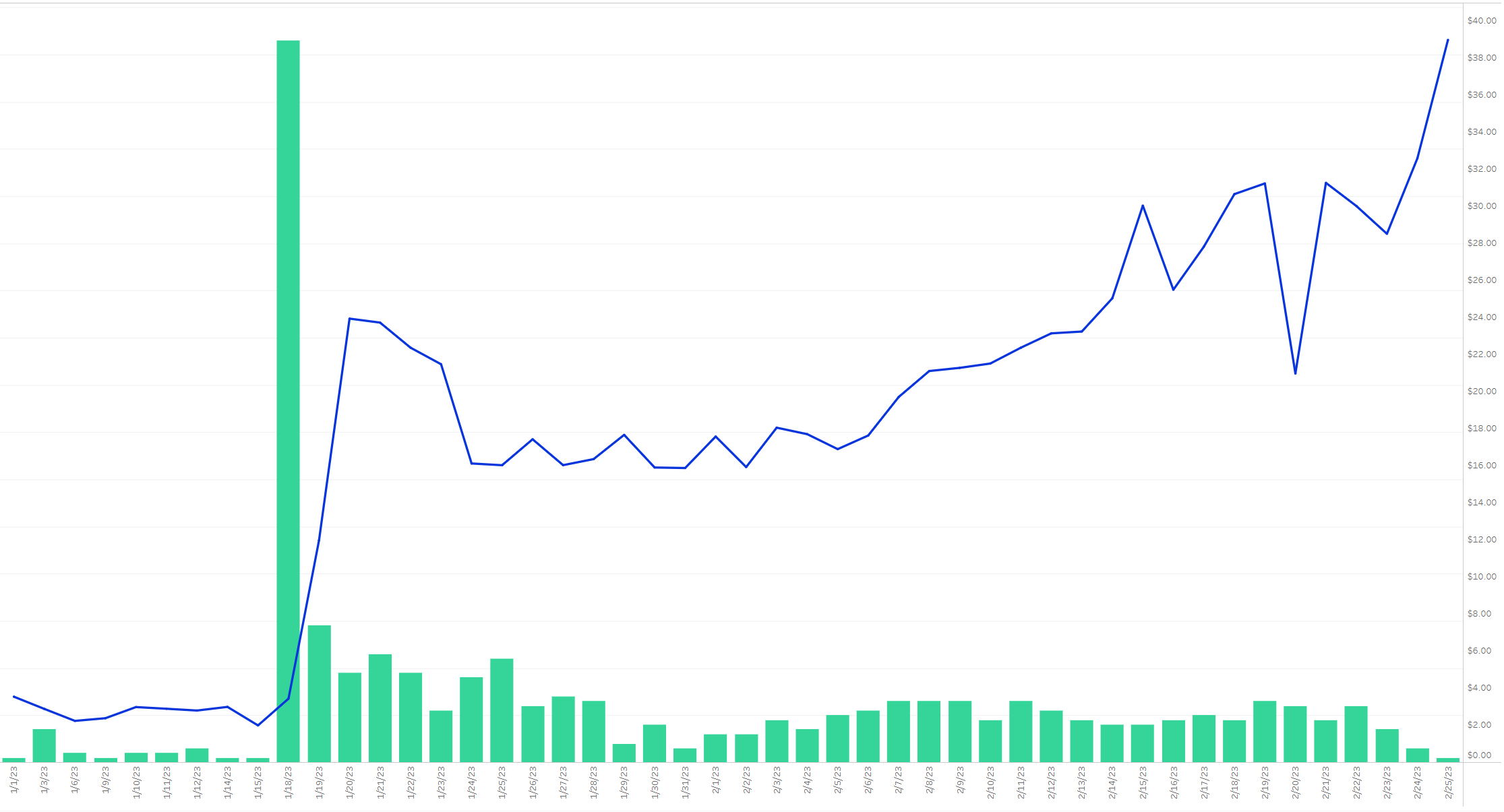

With the reveal of Urtet, Remnant of Memnarch, this $2 Rare from Darksteel surged to $24, then dipped a little. This is pretty typical for a spike like this, and I’d generally start pulling out my extra copies and listing them slightly below market to move them before the hype dies down. In this case, however, Urtet ended up becoming one of the most popular Commanders of the past several years. The card kept surging in price, eventually hitting a whopping $40 on February 25th. If you’d sold right away, you’d have missed out on that massive second price spike.

Except for that spike only really lasted for a few days. As you can see looking at those green bars, very few people bought the card at $50+, so the price came back down. It stabilized around $30 for a while before slowly dropping off again this month as fewer and fewer people are building Urtet decks. Right now, you’d probably be pretty happy to get $20 a copy for Myr Matrix.

A few people managed to get $40-$50 for their copies of Myr Matrix, but your odds of being one of them were incredibly low. If you’d sold into the initial hype, you would have gotten $15-$18 for your copies. If you had waited, you could have made $20-$30. That’s definitely better, of course, but remember: this is one of the few cards where selling into the initial hype wasn’t your absolute best bet, and even here, the difference in expected profit is pretty darn small.

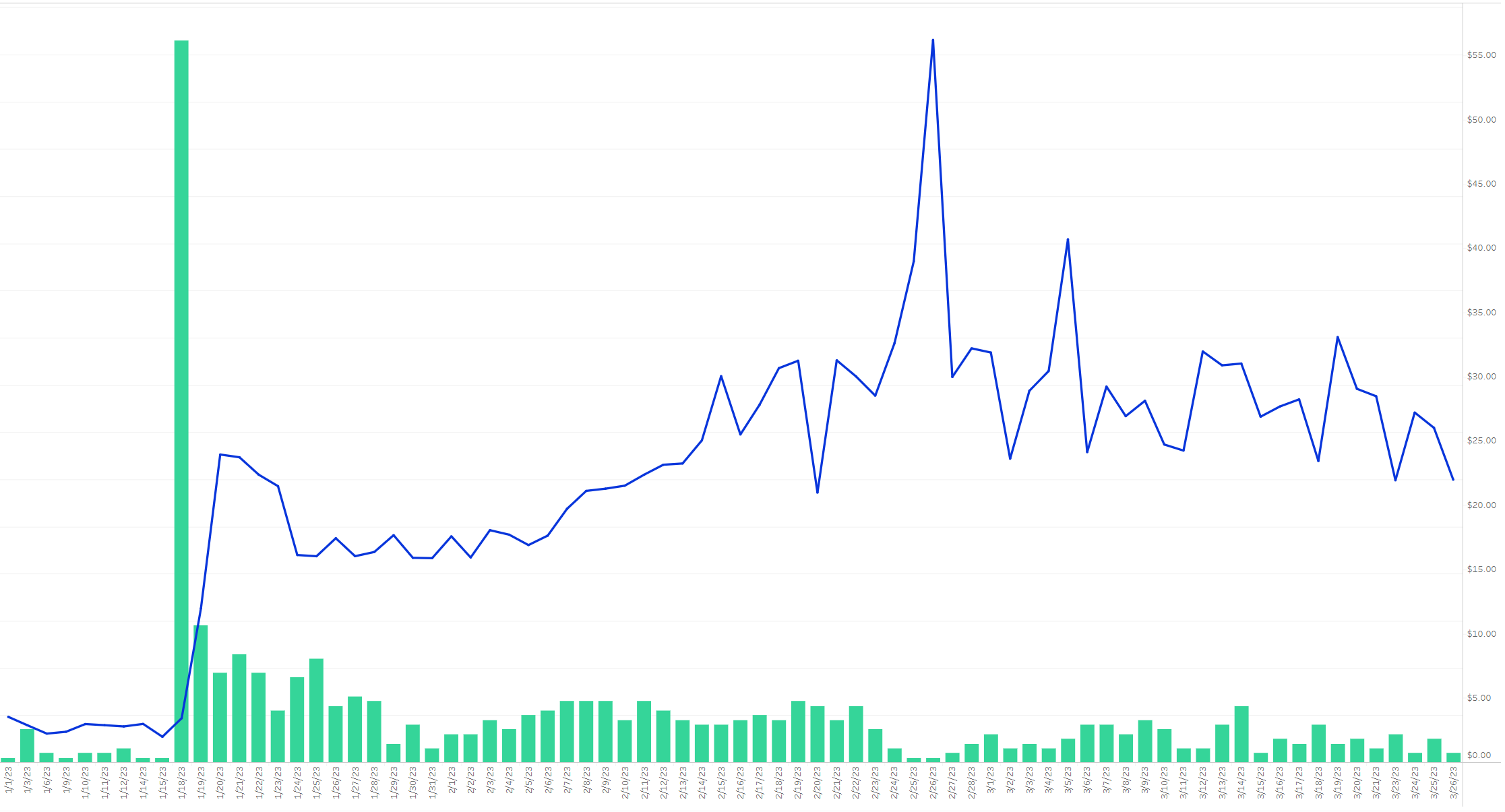

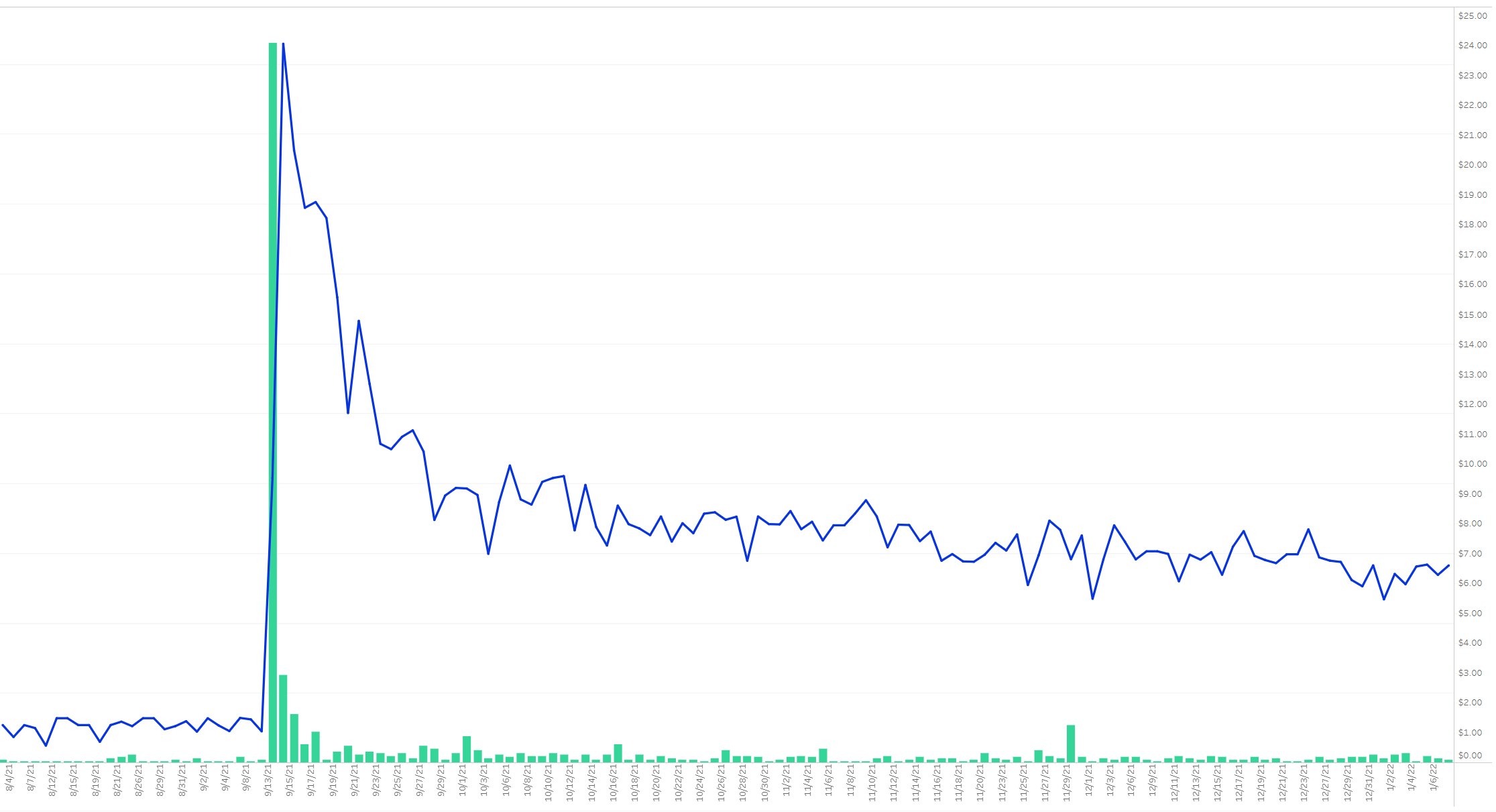

Here’s another card that spiked overnight: Worldfire. It was unbanned in Commander on September 13th, 2021, and the price jumped from $1.50 to $24 in a single day. The fact that it was a Mythic Rare only printed in a single older set, Magic 2013, meant that it had a shot at hitting $50+ if it had become a new auto-include in any Commander strategy that could run it. Nobody wanted to risk waiting too long and having to spend that much on a single former bulk mythic, so they bought in as fast as possible.

With the benefit of hindsight, we now know that Worldfire is a fairly medium Commander card. It’s good in the right shell, but it’s certainly not the kind of card that’s going to command a massive price tag. It’s a $6-$7 card now, the same as it was a few months after the unbanning. That’s still a solid price for your former bulk Mythic Rare, but gosh, we’d all have been far better off selling our copies of this card into that initial surge of demand. Even if you’d cashed out at $10-$12 instead of the full $24, you’d have made quite a bit more than you would if you sold your copies now.

Myr Matrix

Darksteel

Market Price: $26.66

There’s a reason why “sell into the hype” has been a critical heuristic in Magic finance for years. The vast majority of cards that see a hype-related price spike experience a subsequent drop-off, often over the next week or two. While there will be the occasional card you’ll regret selling straight away, this is still the best way to avoid holding onto all your pumpkin futures after Halloween. When in doubt, sell into the hype. Just do it.

At this point, I’d like to offer a plug for my completely free Magic Finance newsletter. I know many of y’all haven’t subscribed yet, and you really should. Most weeks, the newsletter contains an overview and analysis of the cards that have spiked the hardest over the past few days, complete with my recommendations on whether to sell or hold. It’s a great resource for knowing which cards are currently hitting the apex of their hype, and you can use that to plan your sales. Why not take a moment, sign up, then and finish the article? I promise, there are no hidden strings here. It’s just more actionable information from yours truly, delivered right to your inbox every week.

The Hidden Cost of Holding Magic Cards Too Long

Market Price: $28.27

Let’s assume you buy a card for $10, hold onto it for a decade, and sell it for $20. You did it! You had a successful spec, made a few bucks, and everyone’s happy. Right?

Well, inflation has to be part of the equation, too. According to the US Bureau of Labor Statistics website, $10 in 2013 is roughly equivalent to $13 in 2023. So really, you ended up “spending” $13, not $10, on that card if all you care about is the amount of profit you made in the end.

Then you have to factor in platform fees, shipping, and all the rest. A 13% platform fee on a $20 sale is another $2.30, meaning you spent $13 to make $17.70. Throw in a buck for shipping, and now you’ve spent $14 to make $17.70. That’s a profit of $3.70. Not bad, but certainly not the double-up it initially looked like.

Now, this might actually be a pretty solid outcome for your spec. Having access to that card for ten years is a pretty important factor here, and it shouldn’t be ignored. Maybe this particular card ended up as a workhorse in your favorite Commander deck, or perhaps it was part of your massive Modern collection, allowing you to play whatever you wanted on a week-to-week basis. This is the main reason Magic is such an attractive investment: you can’t bring stock certificates down to FNM, but you have access to your card collection for the duration of your time owning them.

On the other hand, it’s worth examining what else you could have done with your $10 over the past decade. For instance, a savings account with a 3% APY would turn your $10 into $13.44 over that same amount of time, allowing you to mostly keep in line with inflation. That’s definitely not as good as the Magic card investment, but have at least mitigated most of your potential losses.

Or you could invest your $10 in the stock market. Historically, the stock market averages about 10% gain per year, though it has been higher in recent years. Your personal gains or losses are likely to be a lot lower or higher if you’re investing in specific stocks instead of in safer index funds, but a 10% gain each year, with compound interest, puts your $10 investment at $25.94 after a decade. That beats the Magic card by about six bucks, and no shipping or hefty platform fees involved.

But maybe you don’t want to wait passively a decade for your investment to pay off. Maybe, you want to take a more hands-on approach. For instance, let’s say every year you decide to sell your spec card and buy another, different card that looks like a better investment with the gross profits. Let’s assume that over the decade, you make a couple of modest gains, a few break-evens and modest losses, and a few decent gains. That chart could still look something like this:

- Year One: $10 into $13

- Year Two: $13 into $20

- Year Three: $20 into $25

- Year Four: $25 into $25

- Year Five: $25 into $20

- Year Six: $20 into $60

- Year Seven: $60 into $70

- Year Eight: $70 into $100

- Year Nine: $100 into $90

- Year Ten: $90 into $110

This is the genuine allure of Magic finance. It’s very possible to make more than ten times your profit over a decade, assuming you’re constantly churning your profits, diversifying your portfolio, and actively working toward better outcomes. Granted, this is a lot more work than simply dropping your $10 into a single card, a savings account, or an index fund for a decade, but the profit potential will always be there if you’re willing to put in the work. And a big part of that work? Making sure you actually sell the cards you’re “making a profit” on, so you can reinvest that money and start the whole cycle again.

Build A Workflow That Works For You

Market Price: $26.70

Market Price: $22.09

Selling cards is easy — but only if you’re doing it all the time. Getting started can be challenging and cumbersome, but once you’ve got a workflow going, selling additional cards becomes effortless. This is why I urge everyone to get started. Once you figure out the best way to handle your card sales, you can kind of keep the assembly line churning for as long as is necessary or desired. For me, a good sales workflow requires five steps:

- First, you’ll want a fully leveled-up TCGplayer marketplace account in good standing. It takes a few sales to get to that point, which acts as a protection against newbies making hundreds of high-value sales right away without knowing what they’re doing, but it’s very possible to get the training wheels off your account fairly quickly as a casual seller.

- Second, you’ll want at least two cardboard boxes for card storage: one for cards that are listed, and one for cards that you’re holding to list in the future. These cards should also be sorted in some way, either by name, color, or set, so that you can find them easily in the future.

- Third, set up a spreadsheet with all the cards you’re willing to sell if the price is right. Make sure you note where the cards are stored, especially if you include cards that are part of existing decks or your active collection. This is a crucial step because if you hear about, say, a Nylea’s Colossus spike, you don’t have to go into your box and rifle around to see if you have a few copies. Instead, you can go to your spreadsheet, control-F for “Nylea’s Colossus,” and learn exactly how many copies you have and where they are. This is also the best way to keep track of what you paid for your cards in the first place, which can help you decide if you want to sell now or wait a little longer.

- Fourth, buy a 4×6 thermal label printer and some labels. Just do it. You can buy them used for about a hundred bucks, and they hold their value really well. That way, you can copy and paste addresses onto a label template instead of having to handwrite addresses.

- Last, make sure you check on your inventory every month or so and your prices line-up with the overall market value. That way, you aren’t stuck with a card listed for $10 even though the market has already dropped to $8, and you don’t notice until it’s all the way down to $4. By checking in often, you can hopefully snag a sale before the card hits bottom in the future.

That’s it! As long as you’ve got some top-loaders, envelopes, and stamps, you’re good to go. It’ll cost you a little bit to get started, and it’ll take up a little space in your bedroom or home office, but it’ll help you so much more cash flow to churn back into future investments or to buy better cards for your collection.

Magic Cards To Keep

Market Price: $60.72

Market Price: $15.79

Market Price: $27.73

Lastly, let’s talk about which cards you might want to hold onto for the long haul. While I recommend selling cards quite aggressively, I’ve definitely had my fair share of regrets, too.

- First, and perhaps most obviously, are Reserved List cards. While you can make money flipping these, and I regret not selling all of mine during the massive price spikes in 2020 and 2021, these cards still tend to perform very well over a long enough period. Plus, if you’re actually worried about getting priced out of ever acquiring certain cards again, don’t ever sell your Reserved List staples. Ditto for any cards you have from sets like Alpha, Beta, Unlimited, Legends, Antiquities, and Arabian Nights. These are the only cards likely to cause intense, long-term regret if you sell them.

- Second, hold onto anything that maintains plenty of sentimental value. Your first-ever foil, cards you got signed by the artist, your favorite Commander, the deck that qualified you for the Pro Tour, etc. These are memories that can’t ever be re-bought, and one day you might feel sad that you sold them. If you don’t truly need the money, keep this stuff, you may regret it otherwise.

- Third, keep key sets of staples in formats you are actively engaged with. For example, if you play a lot of Pioneer, don’t sell your sets of cards like Thoughtseize, Fable of the Mirror-Breaker, or Shark Typhoon. Chances are, you’ll need them for a future deck in the coming months, and you won’t want to worry about re-acquiring them. Play a lot of Commander? Hold onto your copies of Smothering Tithe, Vampiric Tutor, and Fierce Guardianship. If you play a card a lot or think you’ll play with it soon, keeping it is always a solid option.